-

2121 Avenue of the Stars,Suite 800,

Los Angeles, CA 90067

You have spent years building a successful company. The company is now profitable and still growing. How do you know the “best” time frame to sell the business?

There is a “best” time to pursue a transaction. Personal considerations and the stage of the company are the most important factors . External issues such as the industry, competitive dynamics, the market, and tax cycles are secondary factors.

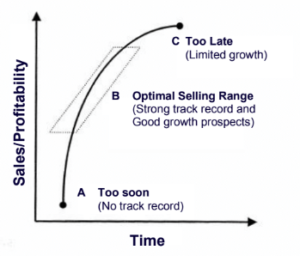

Companies tend to go through a normal maturation process. In the early years, the product or service is being refined, resources are invested into people, equipment, and marketing, the customer base is forming, production capacity is being established, and cash flow, sales and profits are volatile and uneven. During this hyper-growth phase, value is still building and the lack of a financial track record complicates realizing full value for the company.

Successful companies typically enter a mid-life phase of regular growth, effective operations, and productivity gains. During this phase, the financial results become more regular and predictable. From a company perspective, the optimum time to sell a business is during this mid-life growth phase, asshown in Figure 1.

This mid-life growth phase is the optimum time to sell a business because the seller can realize a full value for the business reflecting the expected future growth of the company . If properly marketed, the business valuation will reflect a discounted cash flow valuation analysis based up on a defensible 5 – year forecast . Ineffective marketing will result in a lower valuation based on the current or past financial results of the company. This mid – life predictable growth phase can last many years , and even decade s , before the inevi table maturation of the company.

As the company approach es matur ity , demand for its product or service is stabilizing , competition is increasing , the entrepreneurial drive to develop new products or services may have waned , and growth is slow ing . Unfortun ately, s elling late in the corporate life cycle deprives the seller of value from the expected future growth of the business.

Personal considerations such as health, wealth, and lifestyle also affect the best time for an owner to sell a business . Since it may take years to effect a smooth transition, it is important for the owner to begin the sale process while in good health and well in advance of the company’s maturation.

The benefit s of wealth diversification cannot be overstated, since successful entr epreneurs typically have 80% or more of their net worth tied up in an illiquid single security that is also usually dependent upon their personal involvement in the business. Liquidating such a position provides both wealth diversification and lifestyle options.

Objectively assessing the stage of your company and your personal objectives will help you determine the “best” time to sell your business.

For more information, contact our team of industry experts at Impact Capital Group