-

2121 Avenue of the Stars,Suite 800,

Los Angeles, CA 90067

When selling your company to a strategic buyer, understanding how strategic buyers will view and value your business can help you level the playing field and maximize your transaction.

Strategic buyers purchase and then integrate businesses, so they leverage synergies to generate gains in the near term as the result of careful integration planning and execution.This is in sharp contrast to private equity firms that purchase businesses with the intent and need for a second sale transaction in order to realize gains.

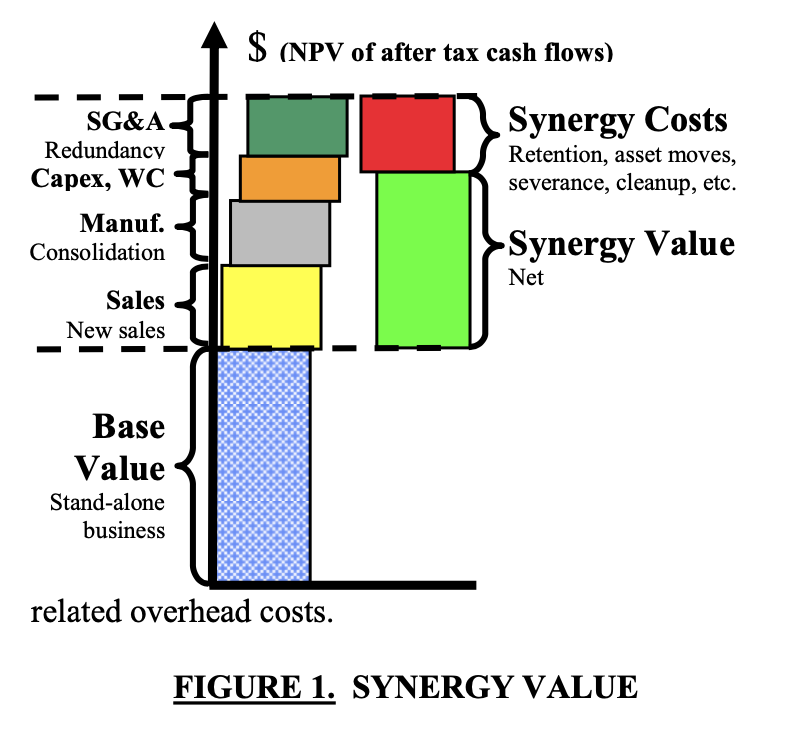

Synergies can be a substantial source of near term value creation, typically ranging from 10% to 100% of the base economic stand-alone value. Of course, there are costs involved to realize synergies and these costs offset the financial benefits of synergies to some extent.

The costs of synergies include such items as retention bonuses for employees during a transition period, severance, production process documentation, asset moves, information system upgrades, facility clean-up, environmental cleanup, and the like.

Total synergies, net of costs, can often add perhaps 50% to the base stand-alone value of the business to be acquired.

Financial engineering can be the source of significant and immediate value creation. Sometimes, the value creation from financial engineering can be so great as to almost pay for the entire acquisition.

Financial engineering creates shareholder value upon closing as a result of one or both of these factors:

Typically, a highly valued and well performing strategic buyer, often a public company, will acquire a smaller privately held or lower performing public company. In such cases, the strategic buyer will likely have valuation multiples, such as P/E and Price/Sales ratios that are greater than the company being acquired.

When the strategic buyer has higher valuation multiples than the target company, then the market will likely apply the buyer’s valuation multiples to the target company’s sales and earnings when the transaction closes, as illustrated in Figure 2.

This upgrade in the valuation multiples is especially likely when the buyer is much larger than the acquired company, the buyer is perceived to be better managed than the target, the transaction is perceived to provide many opportunities for synergies, or the target is privately held so that it incurs an illiquidity discount and/or its valuation multiples are not publicly known.

Suppose a publicly held strategic buyer with a P/E multiple of 20 acquires a smaller, privately held target company having a P/E multiple of 10. Upon closing such an acquisition, the public market will apply the higher P/E multiple of 20 to the earnings of the acquired company. Accordingly, the shareholders of the strategic buyer will immediately achieve an increase in market value for the combined business equal to twice the actual price paid for the acquired company.

Strategic buyers usually finance an acquisition with cash on hand or available debt. Typically, the rate of return for cash on the balance sheet and the interest rate for debt financing are both significantly below the rate of return for the business being acquired.

When the acquired business produces a rate of return (after tax cash flow divided by the price paid for the company) greater than the rate of return for cash on hand or the interest rate cost for debt financing, then the buyer will realize a net benefit from asset margin arbitrage.

Strategic acquisitions can, and often do, fail to produce the desired results for many reasons.

Of course, all of the gains achieved by excellent integration planning, due diligence, financial modeling and execution can be lost due to poor terms and conditions if the negotiation is not handled carefully.

For more information, contact our team of industry experts at Impact Capital Group